Welcome to RealTime Mandarin, a free weekly newsletter that helps you improve your Mandarin in 10 minutes a week.

Subscribe today to get your fluency back, stay informed about China, and communicate with confidence in Chinese — all through immersion in real news.

In the wake of the escalating tariff war between the U.S. and China, nationalist Chinese narratives are echoed and amplified on social media, nudged by obedient algorithms.

"Chinese people aren’t buying it" (中国人从来不吃这一套) is one popular viral meme and an example of how government rhetoric feeds the social media machine. The phrase initially became popular in March 2021, when used by China’s top diplomat at the time, Yang Jiechi (杨洁篪), during tense US-China talks in Alaska. Manya Koetse has written an excellent summary of this and other trending hashtags shaping the tariff war narrative.

Beyond the memes and propaganda, there are stories of businesses across China already feeling the pain inflicted by tariffs.

Chinese officials say the U.S. only accounts for 14.7% of China’s total exports, down from around 20% five years ago. Confident—outwardly at least—that China can better weather this storm.

But many Chinese manufacturers have a much bleaker outlook. They say the impact of tariffs will be far worse than official narratives suggest, as one industry insider explains:

It’s often said that the strength of Chinese manufacturing lies in its "complete industrial system and comprehensive supply chain".

But in a tariff war, this strength can also turn into a vulnerability: if a single end product is hit, it can disrupt the entire supply chain.

我们常说中国制造的优势在于“工业体系完备、产业链齐全”。但在关税战背景下,这种优势也转化为脆弱性:一个终端产品受挫,可能带崩整个产业链。

Others note how some sectors have much higher exposure to the U.S. through exports than the 14.7% average—such as textiles, consumer electronics, and homeware.

The U.S. accounts for roughly 22% of China’s total consumer electronics exports. If this were to suddenly vanish, the entire sector would suffer, including upstream and downstream suppliers. In addition, the high concentration of companies in the electronics supply chain in multiple locations in China, also means what might start as a local problem could escalate into broader, systemic risk.

In Guangdong, for example, major home appliance giants—some of which we’ve discussed before in this newsletter—like Gree (格力), Midea (美的), and Hisense (海信), all have factories in the province, supported by a dense network of upstream and downstream suppliers in the region. If orders vanish, it could lead to mass layoffs, which will then affect consumption—employees will lose their jobs, they’ll lose their income, and have much less money to spend.

China’s policy makers should be worried: boosting domestic consumption is a top priority this year following a collapse in consumer confidence last year in cities like Beijing and Shanghai.

In the homeware sector, Foshan 佛山, a city also in Guangdong province, is one of the world’s largest furniture manufacturing and export hubs, earning it the slogan: “If you have a home, it was likely made in Foshan” (有家就在佛山造). In 2024, Foshan’s total exports exceeded 380 billion yuan ($53.5 billion USD), with furniture and other homeware products accounting for more than half of the city’s export volume.

Tariffs on Chinese-made household products entering the U.S. market will have a catastrophic effect on the city’s economy as one Foshan-based manufacturer explains:

“A lot of clients haven’t fully processed the situation yet.

They’re seeing their own country’s policies changing by the day, so many have asked us to hold off on shipping, but to keep production going for now.

They want to wait and see if the policy will reverse, and in the meantime, they want time to renegotiate pricing with downstream buyers.”

“其实客户也没反应过来,眼看着自己国家的政策每天都有新变化,所以让我们先不要发货,但是保持生产,看看后面有没有反转再做决定,客户也需要时间跟下游买手谈提价的问题。”

The prevailing mood among China’s exporters is one of “resignation” (无奈), and to “wait and see” (观望).

One media outlet, LatePost (晚点), has interviewed entrepreneurs who export to the US, across a range of industries at different points in the supply chain—all private businesses, many still run by the founders who started from nothing.

One entrepreneur interviewed is Cheng Ning (程宁), a former English teacher who started his own business in 2015 exporting low-cost tableware and home goods. The US makes up 80% of his sales.

For him, when tariffs first rose to 20% earlier this year, Cheng said he was able to negotiate with his U.S. buyers, who agreed to absorb by the additional cost, and then passed it on to American consumers.

But at 54%, the costs were too steep. His buyers pushed him to lower prices.

At 125%, he was out of options. Customers who were ready to order began to stall.

Cheng is worried:

“This is the biggest challenge I’ve faced since starting my business.”

这是我做生意以来碰到过的最大挑战

Still, like many entrepreneurs, he’s trying to be optimistic. In his view, the high tariffs won’t last. He reckons three to six months is how long it will take until China and the US return to the negotiating table.

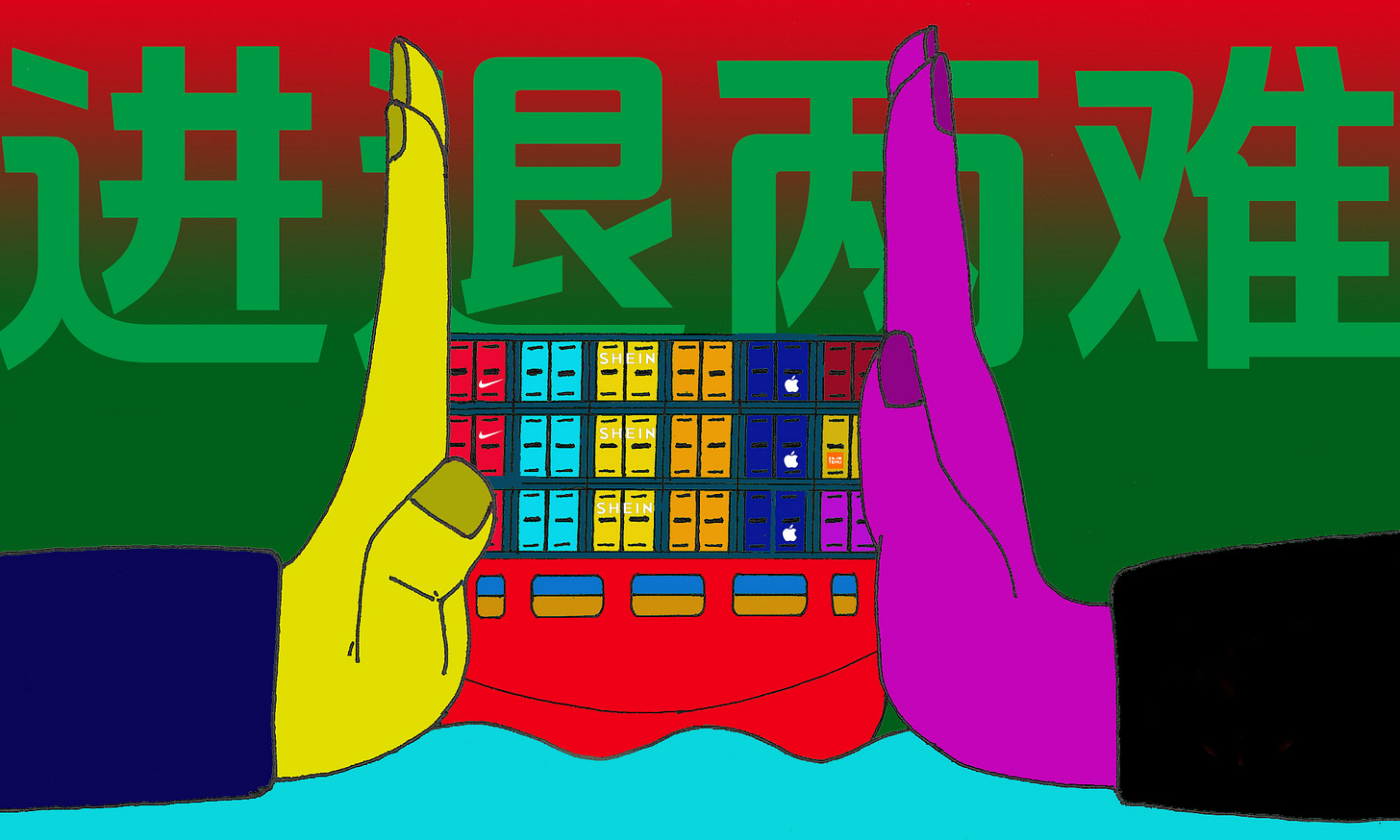

LatePost summed up this dilemma, and many like his, with an old idiom:

Trading companies are caught between a rock and a hard place. All they can do is to wait.

贸易公司:进退两难,唯有等待。

So, that’s what we’re exploring this week!

🎧RTM Podcast Preview

This week on the RTM Advanced podcast, we’re diving into the language of tariffs, change, and waiting.

Each of these ideas can be expressed with at least two different phrases in this newsletter, each carrying its own nuance, connotation, and level of formality. Choose the wrong one for the situation, and the meaning can shift completely

“Impose (tariffs)” — 加征 jiāzhēng, or 加 jiā? (Listen at 9:48)

“Dramatic change” — 巨变 jùbiàn, or 剧变 jùbiàn? (Listen at 11:45)

“Watch and wait” — 观望 guānwàng, or 静观其变 jìngguān qí biàn? (Listen at 14:42)

We’ll break down each phrase, unpack the subtle differences, and show you how native speakers choose the right words, so you can too!

Favourite Five

1. 韧性 rèn xìng

resilience, tenacity

中国跨境人的韧性,都是被政策逼出来的 - The growing resilience of Chinese cross-border traders is the direct result of the ever-changing policies. [4]

2. 团灭 tuán miè

total wipeout, complete failure

最坏的情况下,储能在美国的业务会被“团灭” - In the worst-case scenario, the energy storage business in the U.S. will be totally wiped out. [4]

More: an internet slang phrase from the gaming world

3. 关税战 guān shuì zhàn

tariff war, trade war

特朗普政府并不期待谈判结束战事,而是希望“关税战”成为新常态 - The Trump administration didn’t expect negotiations to end the trade conflict but hoped the tariff war would become the new normal. [1]

Related:

关税 guān shuì – tariff

加征 jiā zhēng – impose (tariffs)

豁免 huò miǎn – exemption

壁垒 bì lěi - barrier, trade barrier

4. 进退两难 jìn tuì liǎng nán

caught between a rock and a hard place

贸易公司:进退两难,唯有等待 - Trading companies are caught between a rock and a hard place. All they can do is to wait. [4]

More: Tune in to tomorrow’s Sinica Phrase of the Week for more on this old idiom.

5. 静观其变 jìng guān qí biàn

wait and see, observe how things develop

听说一些同行这几天都放弃抵抗,静观其变了 - I heard some in the industry have stopped finding workarounds these past few days, and are now just waiting to see how things develop. [4]

More: We discuss the nuances of this idiom in the RTM Advanced podcast!

💡 Ready to get inspired to bridge the gap to real-world fluency? 💡

Every RTM+ post is packed with tools to inspire and help you get fluent.

It's designed to fit your busy life, your learning style, and your level—whether you’re “intermediate”, “advanced but rusty”, or “fluent with gaps”.

So, ready to get inspired and finally get back to real-world fluency?

Let’s jump in👇