New mortgage product allows people over 60 to apply mortgages

Discussions about passing debts onto the next generation

Welcome to RealTime Mandarin!

It’s a free weekly resource helping you learn contemporary Chinese in context, maintain and improve your Mandarin skills, and stay on top of the latest language trends in China.

Subscribe now to get the next newsletter in your inbox on Saturday.

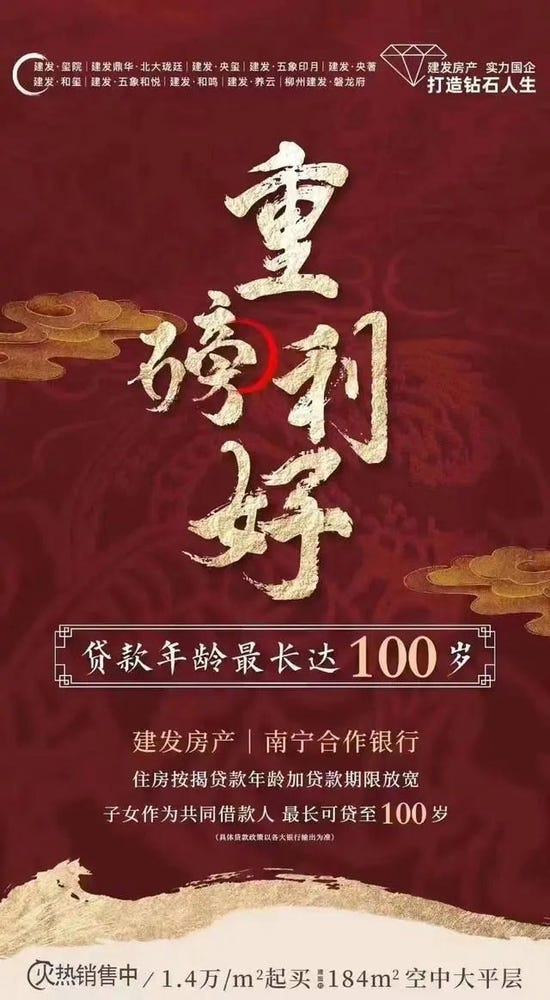

Some banks in the cities of Nanning, Hangzhou, Ningbo and Beijing have extended the upper age limit on mortgages to 80 and even 90 years old.

Internet users in China have invented idiomatic puns criticising the policy. They play on the use the character for "debt" (贷 dài), which is pronounced the same as the word for "generation" (代 dài).

Social media comments containing new idioms about “debt” and “generations” include:

贷贷相传 dài dài xiāng chuán - "indebted for generations", instead of passing from one generation to the next (代代相传 dài dài xiāng chuán);

世世贷贷 shì shì dài dài - "in debt generation after generation" instead of generation after generation (世世代代 shì shì dài dài);

子孙后贷 zǐ sūn hòu dài - "next generations are in debt" instead of future generations (子孙后代 zǐ sūn hòu dài).

Discussions in the media are a bit more balanced. One view is that it’s a good way to generate economic activity, and that people should trust the markets:

Many people ridiculed banks for raising the maximum repayment age for lenders. This is essentially a lack of trust in the market. A ‘relay loan’ is just market behaviour. Of course, it is risky for banks, but as a rational market entity, how can banks not be aware of the risks involved? Banks have always been the place with the strictest risk controls and the place where the risk-benefit ratio is the most important. The real risk often does not come from the business itself, but from irrational market intervention.

许多人嘲笑银行提高贷款人的最高还款年龄,本质上是对市场化的不信任。“接力贷”只是一种市场行为,它当然于银行来说有风险,但作为理性市场主体,银行岂会不清楚这里面的风险?银行历来是风控最严格的地方,也是最讲风险收益比的地方,真正的风险往往不是来自于业务本身,而是来自于不理性的市场干预。[1]

So that’s what we explore this week: The language of debt and death.

This week’s member podcast is already live. It’s 30 minutes of delicious Chinese language learning content! Sign up now to access it and a load more learning resources.

Favourite Five

1. 韭菜 jiǔ cài

garlic chives; the gullible

银行就是希望贷贷相传呗,不怕,韭菜会给出答案 - The bank wants to see the debts passed down to the next generation. They are not worried, because the people will pay. [5]

Note: Garlic chives are a metaphor for “the gullible” which comes from the phrase 割韭菜 gē jiǔcài - to rip the people off. But just like garlic chives which grow back quickly, the next crop of gullible customers is not far behind.

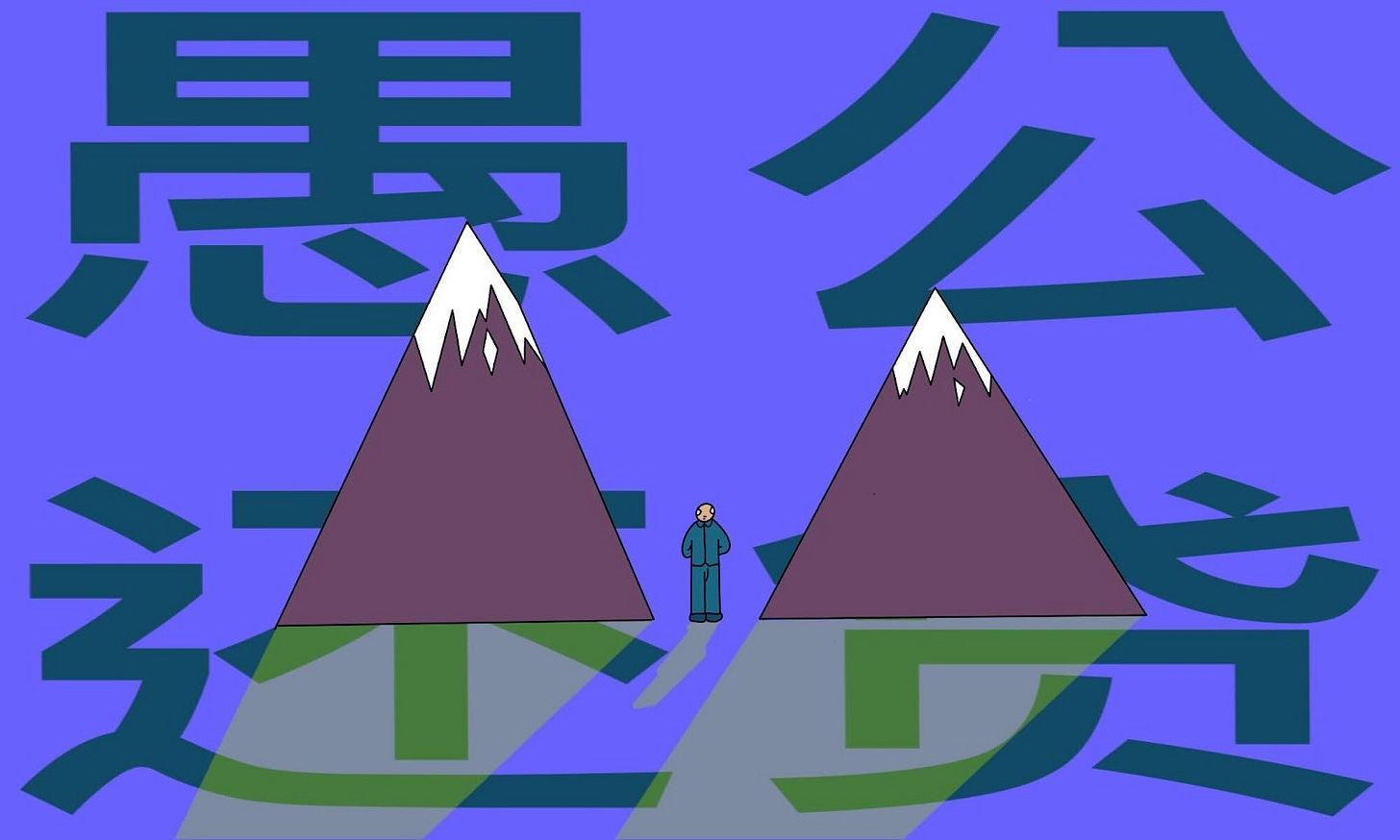

2. 愚公还贷 yú gōng huán dài

Passing your debts onto the next generation

以前愚公移山子孙无穷尽也,现在愚公还贷,子孙无穷尽也 - In the past, the Stupid Old Man moved mountains to secure a better life for his descendants. But now he repays the loan while he is alive, and passes the debt onto his next generation. [5]

Note: Inspired by the idiom, the Stupid Old Man moves the mountain (愚公移山 yú gōng yí shān), which we discuss more in The China Project Phrase of the Week.

3. 传宗接贷 chuán zōng jiē dài

passing debts from generation to generation

刺激房地产市场,不见得非要采用“传宗接贷”式的按揭贷款方式 - Stimulating the property market doesn’t have to be done by burdening people and their next generations with mortgages. [3]

Note: From the idiom 传宗接代 - continue the bloodline.

4. 千秋万贷 qiān qiū wàn dài

indebted for generations

网友将这波房贷政策松绑戏称为“千秋万贷”、“贷贷相传”,但实情可能并非如此片面 - Internet users jokingly described this round of mortgage policies as “indebted for generations”, “debt is passed on from generation to generation”. But in actual fact it’s not like that. [2]

Note: From the idiom 千秋万代 qiān qiū wàn dài - 'a thousand autumns and ten thousands generations', which means 'for generations'.

5. 家祭无忘告乃翁 jiā jì wú wàng gào nǎi wēng

remember to let me know the good news when sweeping my tomb

房子贷款还清日,家祭无忘告乃翁 - When the mortgage is paid, don't forget to share the good news with your parent (who has passed away). [5]

Note: The last line in the Lù Yóu 陆游 poem, To My Son 示儿 shì er. It’s probably the Song dynasty poet’s most famous work, in which he expresses regret that China is still not united when he dies, asking his son to tell him when it does finally happen when sweeping his tomb.

Consuming the Conversation

Useful words

6. 炒房 chǎo fáng

buying properties as an investment not to live in

他们不囤房不炒房,改善型这一类老年人大多财务状况健康 - They do not buy up or speculate on real estate. Elderly who buy to improve their living conditions tend to be financially healthy. [1]

7. 杠杆 gàng gǎn

leverage

在高房价的背景下,不加杠杆,就意味着房子卖不动 - In the context of high housing prices, with no leverage houses cannot be sold. [2]

More: Zoe explores this word and how to use it in the podcast.

8. 掏空 tāo kōng

empty out

以前是掏空爹的存款,现在是掏空儿的存款 - It used to be spending their parents' savings (on a house). Now, the parents will be borrowing from their kids. [5]

9. 苛责 kē zé

very harsh

社会大众无需苛责,‘非黑即白’的评价模式,不利于各地政策的因城施策开展 - There is no need for the public to be so critical. Black and white thinking is not conducive to the targeted implementation of local policies. [2]

10. 血液 xuè yè

blood, cashflow

促进就业,增加居民的收入,就是增加市场的流动的血液 - Promoting employment and increasing the household income increases the flow of cash in the market. [3]

Note: 吸血 xī xuè - blood sucking, taking people’s money

11. 流水 liú shuǐ

flowing water, cashflow

银行已经核实贷款人收入流水满足贷款要求 - The bank has verified that the borrower's income flow meets the loan requirements. [4]

Note: Blood and water are both used as metaphors for cash. water metaphor is more microeconomic (personal & business ect.), but blood is more macroeconomic (markets).

12. 默许 mò xǔ

acquiescence; accept

这说明,至少银行已经默许了这种情形的存在 - This shows that at least the bank has accepted this situation. [1]

Three-character phrases

13. 啃老团 kěn lǎo tuán

gnawing old group; people who live off their parents

除了保健品、电信诈骗、啃老团以外,终于又看上老年人的退休金了 - In addition to health supplements, scam calls, and people living off their parents, finally they have got their eyes on the pension pots of the elderly. [1]

Related: 啃老 kěn lǎo to sponge off one's parents. A social media slang we looked at last July.

14. 接力贷 jiē lì dài

relay loan

百岁”还贷“老人?延长期限更加类似“接力贷” - 100 year-old person repaying a loan? Extending the age limits for mortgages is more like a guarantor loan. [2]

Note: This is when a parent signs a mortgage agreement with their child, kind of like a guarantor.

Related: 合力贷 hé lì dài - joint loan

15. 烂尾楼 làn wěi lóu

unfinished building

烂尾楼不管,房贷挺会想办法 - They do nothing about developers of unfinished housing projects. But they do everything to encourage people to take out mortgages. [5]

Note: 烂尾楼 làn wěi lóu is part of why and how China’s property market is in such trouble - developers taking borrowed money secured against personal assets of retail customers for “off plan” homes and then running out of money before they are completed - leaving the hopeful new residents with no money or home.

Idioms

16. 耄耋之年 mào dié zhī nián

an old person

使贷款期限得以延长,并非让购房者孜孜不倦还贷到耄耋之年 - To increase the age limit is not intended to make home buyers repay the loan until old age. [2]

More: 耄耋 mào dié - aged 80-90 (two new characters on me!)

17. 杀鸡取卵 shā jī qǔ luǎn

kill the chicken to get the eggs; kill the goose that lays the golden eggs

这种策略具体应用到房地产市场,无异于杀鸡取卵 - Applying this strategy to the real estate market is tantamount to killing the chicken to get the eggs. [3]

Note: Often coupled with 无异于 wú yì yú - no different to

18. 源头活水 yuán tóu huó shuǐ

source of running water; source of knowledge, growth (in this context)

只要居民收入提高了,市场的源头活水将源源不断地流淌 - As long as household income continues to rise, the market will continue to grow. [3]

19. 安居乐业 ān jū lè yè

live and work in peace and contentment

降低房价和贷款利率,有房子住才能安居乐业 - They need to reduce housing prices and interest rates, so that everyone can afford a place to live. That's the basis for a good life. [5]

Phrases

20. 接力还贷 jiē lì huán dài

passing on debts

在这一波房地产去化的大潮中,“接力还贷”,提高最高还款年龄已经在很多城市流行起来 - In the current wave of selling houses, many cities now allow debts to be passed onto the next generation by increasing the age limit of borrowing. [1]

21. 有...之虞 yǒu... zhī yú

in danger of

改善型这一类老年人大多财务状况健康,加点杠杆也大多无风险之虞 - Elderly who buy to improve their living conditions tend to be financially healthy, so this kind of borrowing poses little financial risk. [1]

22. 病急乱投医 bìng jí luàn tóu yī

try anything when in despair

最近南宁轨道地产推出的“购房享受免费坐地铁10年”福利活动,也算是“病急乱投医”了 - Recently, Nanning Railway Real Estate launched a promotion called "buy a house and enjoy free subway rides for 10 years". It’s a desperate move. [1]

More: We previously discussed this in March last year.

23. 撇脂策略 piē zhī cè lüè

market-skimming pricing

其实质是撇脂策略的变相应用 - This is essentially market-skimming pricing to get people’s money. [3]

24. 松绑政策 sōng bǎng zhèng cè

loosening policy, deregulation

这是当地为了促进购房采取的一种松绑政策 - This is deregulation adopted by the local government to encourage house purchases. [4]

Become a member of RealTime Mandarin+

The RealTime Mandarin+ membership is a multimedia resource helping you learn contemporary Chinese in context

If you enjoyed reading the free newsletter, you’ll LOVE our paid membership: RealTime Mandarin+.

Joining Real-Time-Mandarin+, you’ll unlock loads of extra resources to help you dramatically improve your Chinese language skills.

Every week you get access to new content:

🔈Podcast - 30 min podcast every Saturday with 80% native Mandarin (including transcript)

📚 Resources and integrations - Pleco, Skritter, Hack Chinese, mylingua (new!), and PDF printouts

👩🎓 Intermediate newsfeed - One ‘real’ Chinese language news podcast and article published every Sunday, in a lesson format, pitched at an intermediate level

💬 Community - Slack community, Substack Chat, online meet-ups, in-person gatherings

🤿 Quarterly Deep Dives - One hour webinars focussing on one key challenge of intermediate learners delivered around the end of every quarter.

When you join, you’ll also have an optional 1-1 onboarding and coaching call to help orientate you.

It’s the best way to get motivated, inspired, and kick-start your Mandarin learning habit.

You can access all of these resources for less than the cost of one pint per week in a London pub.

It’s a no brainer (and much better for you)!

So, if you’ve been on the fence for a while, now is the time to confront it, invest in yourself, and commit!

Happy learning!

Andrew