Welcome to RealTime Mandarin, a free weekly newsletter that helps you improve your Mandarin in 10 minutes a week.

Subscribe today to get your fluency back, stay informed about China, and communicate with confidence in Chinese — all through immersion in real news.

I’ve spent the last week in Beijing and Shanghai, and during that time I had the opportunity to talk to lots of entrepreneurs to get a feel for what business is like in China right now.

All the entrepreneurs I spoke to are obsessing over one thing: “Going global” (出海).

With fierce competition and weakening consumer spending at home, companies are looking for new growth opportunities abroad. For them, it’s about survival, as the popular saying goes:

If you don’t go global, you’re going down!

不出海,就出局!

Many “go global” attempts don’t work out. I’ve seen this for myself in the UAE and Saudi in recent months, which are currently two of the popular destinations for Chinese investment, captured in the phrase, “the Middle East is hot” (中东热). The cultural gap, lack of trust and understanding on both sides, and working with the wrong partners are just some of the causes of failure.

But plenty of Chinese companies have also gone global successfully. And some have done it without having to build businesses in foreign markets from scratch.

Through acquiring well established but struggling Western “heritage” brands, Chinese investors turn companies around through increased efficiencies, reduced costs, and opening up China’s huge consumer market for these international brands.

We’re discussing one of these companies this week, which is the sportswear conglomerate, Anta Group (安踏集团). Founded in 1991 and listed on the Hong Kong Stock Exchange since 2007, Anta has become China’s dominant domestic sportswear player with a market capitalisation of around $28 billion.

Last week, Anta announced it is acquiring a 29.06% stake in Puma SE for €1.5 billion ($1.8 billion), becoming the German sportswear brand’s largest shareholder. Anta is purchasing approximately 43 million Puma shares from owner, Groupe Artémis, at €35 per share which represents a 62% premium over Puma’s closing share price on the day before the announcement.

Related

The deal comes as Puma is struggling on multiple fronts.

Its shares have plummeted nearly 50% in value over the last year. Sales in the first nine months of 2025 declined by 4.3%. And in the Greater China market, its business made cumulative losses of €309 million in the first three quarters of 2025.

Puma has also lost ground to established brands like Nike and Adidas, and upstart challengers like On Running and Hoka. Puma’s products are consistently behind trends set by its competitors, like when Adidas launched its retro trainer, Samba, roughly six months before Puma could respond to the resurgence of that trend.

Arthur Hoeld, who took Puma’s helm in July 2024, quickly announced a comprehensive turnaround plan soon after joining. It was a “strategic reset”, including cutting 900 corporate jobs, which is roughly 5% of Puma’s 20,000-person workforce globally.

So it’s into this turnaround scenario that Anta arrives, with cash, experience, and ambition.

Anta’s “go global” strategy has centred on acquiring and revitalising Western sports and lifestyle brands through what it calls “single-focus, multi-brand, globalisation” (单聚焦、多品牌、全球化).

The company’s portfolio now includes many well-known international brands, like FILA, Descente, Kolon Sport, Jack Wolfskin, and Maia Active. And in 2019 Anta led a consortium that acquired Amer Sports for $5.2 billion—a deal that brought Arc’teryx, Salomon, Wilson, Peak Performance, and Atomic under Anta control. For high-end outdoor apparel brand, Arc’teryx (始祖鸟), that deal delivered exceptional growth through expansion in China, despite its recent reputation challenges.

Ding Shizhong (丁世忠), Anta’s chairman, framed the Puma investment as the next chapter in this playbook:

“This acquisition marks a major step forward in our ‘single-focus, multi-brand, globalisation’ strategy.

Working with Puma, we look forward to learning from each other and joining hands to fully unlock the brand’s full potential.”

这是安踏“单聚焦、多品牌、全球化”战略的重要里程碑。未来双方在高度共识的领域开展协作、优势互补,为该品牌的复兴之路提供有益的支持 [4]

In China, industry analysts have mixed views on the investment.

Some see it as “strategically complementary” (战略互补). Because geographically Puma is strong in Europe and Latin America but weak in China and North America, where Anta has deep operational experience and distribution networks. Puma is also strong in some product categories where Anta has gaps, like football (soccer), motorsports, running, and basketball.

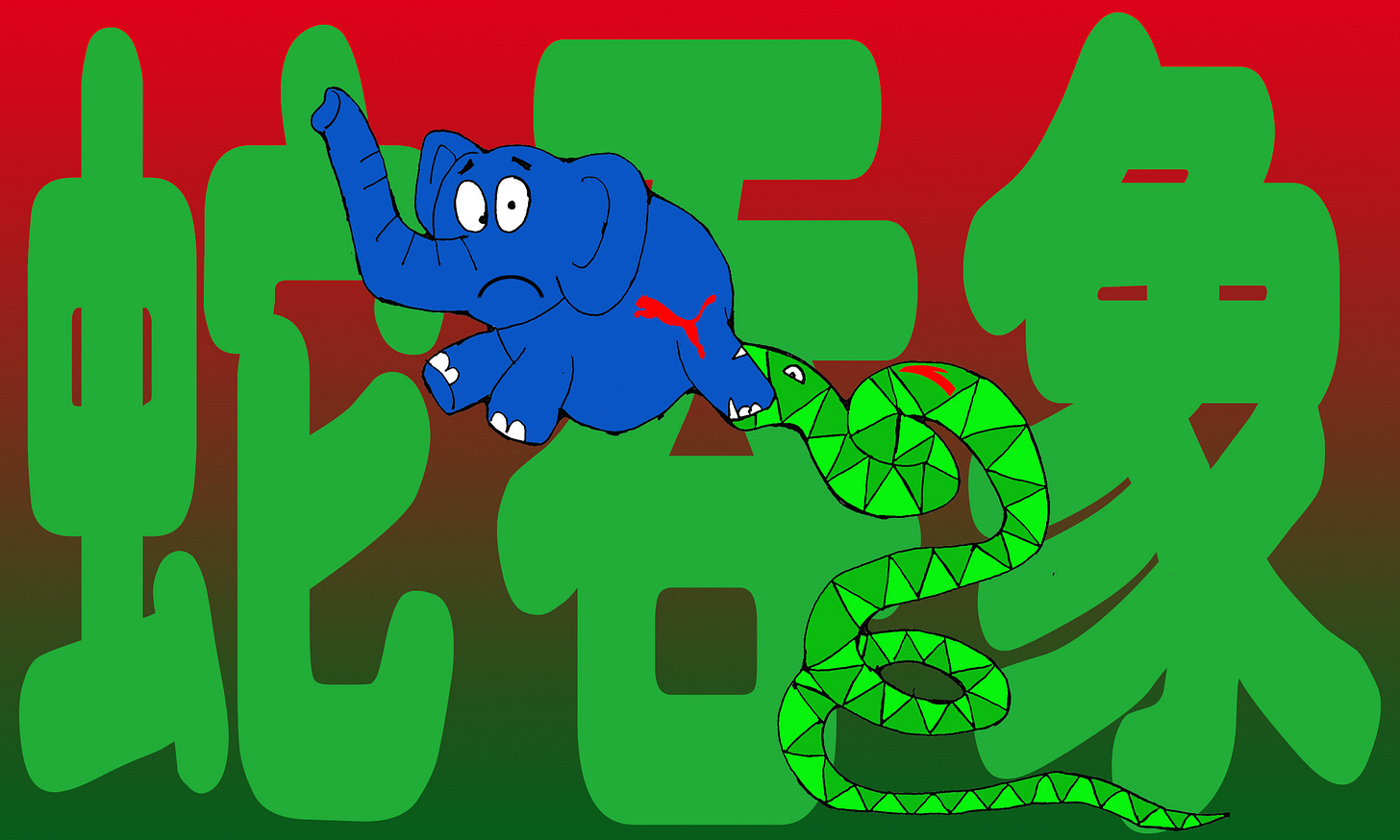

But others reckon that as Anta’s portfolio grows, maintaining distinct brand identities will become increasingly difficult, leading to excessive “homogenisation” (同质化) and even “cannibalisation” (品牌互噬) of its brands. Some investors are also concerned that Anta has bitten off more than it can chew by financing the deal from its own cash reserves, using a colourful Chinese phrase to make the point:

With an acquisition price tag exceeding 10 billion RMB, the market is closely scrutinising Anta’s financial health.

After all, the 2019 deal where an Anta-led consortium acquired Amer Sports for approximately €4.66 billion was widely characterized as “a snake swallowing an elephant”.

斥资超百亿进行收购,市场非常关切安踏的财务健康状况。毕竟,2019年安踏牵头财团对亚玛芬体育约46.6亿欧元的收购,就曾被外界形容为一笔“蛇吞象”交易。

However, most observers agree that the deal offers Puma an opportunity for immediate China market expansion which will be good for its short-term growth.

Anta’s deep understanding of Chinese consumers, its sophisticated “Brand + Retail” (品牌加营销) business model, and its extensive distribution network could dramatically accelerate Puma’s China market presence.

So that’s what we’re exploring this week!

Favourite Five

1. 赋能 fù néng

empower, enable

外界同样关注的是安踏在经营层面对彪马的赋能 - The outside world is also paying close attention to how Anta is empowering Puma at the operational level. [2]

2. 蛇吞象 shé tūn xiàng

a snake wallowing an elephant, biting off more than you can chew

2019年安踏牵头财团对亚玛芬体育约46.6亿欧元的收购,就曾被外界形容为一笔“蛇吞象”交易 - The 2019 deal where an Anta-led consortium acquired Amer Sports for approximately €4.66 billion was widely characterized as “a snake swallowing an elephant”. [3]

3. 如愿以偿 rú yuàn yǐ cháng

to have one’s wish fulfilled, to get what one wanted

如今安踏集团董事局主席丁世忠算是如愿以偿 - Today, Anta Group’s chairman Ding Shizhong can be said to have finally achieved what he wanted. [2]

4. 一拍即合 yì pāi jí hé

to hit it off immediately, to agree instantly

彪马期待安踏带来“品牌重塑”,安踏看上了彪马的全球品牌资产基本盘,因此一拍即合 - The deal represents a perfect synergy: Puma is banking on Anta’s expertise in brand repositioning, while Anta seeks to capitalize on Puma’s global brand equity. [3]

5. 可遇不可求 kě yù bù kě qiú

rare and hard to come by, cannot be forced

好的品牌基因与价值沉淀可遇不可求 - Strong brand DNA and legacy cannot be bought and are hard to come by. [1]

🎧RTM Podcast Preview

This week on the RTM Advanced podcast, we explain three cool idiomatic phrases which mean “acquisition”.

Tune in at 7 minutes where we break down what they mean and the stories behind them…

How native speakers use them…

And how you can use them in real conversations right now and show off your amazing Chinese!

Consuming the Conversation

💡 Ready to get inspired to bridge the gap to real-world fluency? 💡

In every RTM Advanced post you unlock content and tools to inspire you, and help you get fluent.So, ready to finally get started and wave goodbye to that nagging rusty feeling?

Let’s jump in👇

Consuming the Conversation

Useful words

6. 筹谋 chóu móu

to plan, to scheme

这是一场筹谋已久的交易 - This deal has been years in the making. [1]

7. 接盘 jiē pán

to take over, to assume control (often of a troubled asset)

安踏则是传闻中最有可能的接盘者 - Anta was rumoured to be the most likely party to take over. [1]

Related:

接手 jiē shǒu – to take over, to assume responsibility

8. 战绩 zhàn jì

track record

过往的成功战绩已经让安踏成为一个国际化的并购品牌 - Its proven track record has already made Anta a global serial acquirer. [1]

9. 铁腕 tiě wàn

iron-fisted, tough-handed

安踏是否会掀起一轮更铁腕的渠道改革 - Will Anta force an even more aggressive channel reset? [2]

10. 撬动 qiào dòng

to leverage, to pry open

通过一个相对较小的财务投资,撬动对一个庞大潮流生态在中国市场运营的深度参与权 - Anta uses a relatively small amount of capital to secure an outsized strategic influence over this global brand’s operation in China. [3]

11. 拼图 pīn tú

puzzle piece, missing piece

彪马则可以填补安踏在国际流行运动及专业体育细分领域的拼图 - Puma serves to complete Anta’s strategic puzzle, as it fills the critical gaps in both global athleisure and high-performance athletic niches. [4]

12. 契合 qì hé

to align with, to fit well

因为这家德国公司很好地契合了该运动服装公司的全球化战略 - Because the German company aligns well with the sportswear company’s globalization strategy. [4]

13. 解药 jiě yào

antidote, solution

安踏与彪马,能否成为相互的解药 - Anta and Puma: Can they become each other’s strategic remedy? [4]